What is an Offer for Sale (OFS)?

Imagine you're at a bustling market where people buy and sell various items. An OFS (Offer for Sale) in the stock market is like that, but instead of goods, it involves selling company shares.

It's a way for existing shareholders, like the company's founders or big investors, to offer their shares to the public. This helps cash out their investments and gives regular folks like us a chance to buy into the company at a set price.

How to Apply For an OFS:

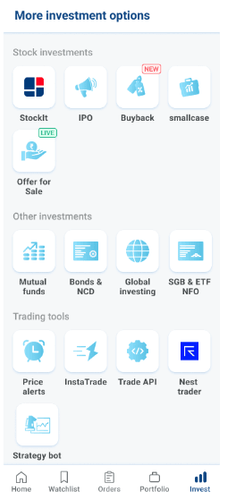

Step 1: Navigate to Invest > OFS.

Step 2: Click on any scrip in the Live section.

Step 3: Read about the OFS details and which category you want to apply in.

Step 4: Enter your bid quantity.

Step 5: Click on “Place Order” in Order Confirmation.

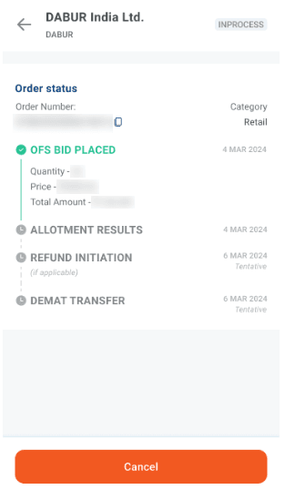

Step 6: In the Orders tab, you will be able to see all your existing/past orders.

Frequently Asked Questions

Do I need cash/margin to place an OFS bid?

OFS bids are placed against 100% cash. Please ensure you have the same in your trading account before placing a bid.

What do you mean by the Retail, Non-Retail and Employee categories?

When participating in an OFS in the stock market, there are different categories you can choose from based on how much you want to invest and who you are:

The Non-retail category lets you bid for more than Rs. 2 Lakhs right from the start, on the first day of the OFS. It is for big investors who want to make significant moves.

The Retail category is ideal for individual investors looking to buy smaller amounts of shares. Your bids must be less than Rs. 2 Lakhs, and you get to join in on the second day of the OFS.

The Employee category is like a special pass for company insiders. If you are a current employee of the company offering the shares, you can bid less than Rs. 5 Lakhs on the second day of the OFS.

Each category has its own rules to ensure fairness and transparency, so pick the one that suits your investment style and status. Happy bidding!

I have placed a bid for an OFS, what will happen to the amount against which I have placed the order?

OFS bids will be placed against 100% cash, and the equivalent will be blocked for further use until the allotment results are announced or till you cancel the order.

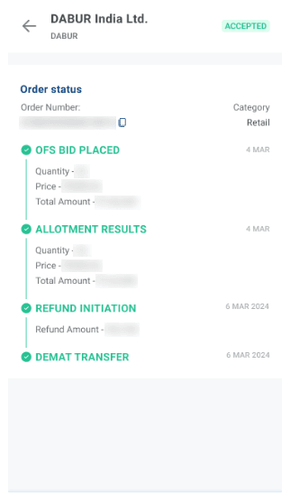

How do allotment, shares transfer and refund work?

Consider the scenarios given below:

i. Full allotment

You placed

Quantity: 10

Price: Rs. 100

Your allotment Quantity: 10 Price: Rs. 100

No refund will take place. Shares will be transferred to your demat account within 1-2 working days.

ii. Partial allotment

You placed

Quantity: 10

Price: Rs. 100

Your allotment Quantity: 5 Price: Rs. 100

In this case, a refund of Rs. 500 will be made to your trading account within 1-2 working days and the shares allotted will be transferred to your demat account within 1-2 working days.

iii. No allotment

You placed

Quantity: 10

Price: Rs. 100

No Allotment was done

In this case, a refund of Rs. 1000 will be made to your trading account within 1-2 working days.

Can I do multiple bids?

Yes, you may place multiple bids for an OFS against equivalent cash in your trading account, but here are a few things to keep in mind:

i. If you place a bid under the Non-Retail category on the 1st day of the OFS, you will not be allowed to place a bid under the Retail or Employee categories on the 2nd day.

This applies irrespective of you getting an allotment under the Non-Retail category.

ii. On the 2nd day of the OFS, you can choose to apply under Retail/Employee or both.

Remember the category limits for Retail/Employee.

Can I cancel my bid?

Yes, you can cancel your OFS bid during market hours only.

What are the OFS timings for order placement and cancellation?

OFS Start Time: 9:15 AM

OFS End Time: 3:00 PM