What is a daily margin statement and how to interpret it?

The daily margin statement informs you about your margin status, i.e., what free margins are available in your account in order to take new positions without having to pay any charges or penalties. According to the exchange regulations, as brokers we need to send you a margin statement everyday on your registered email ID.

Interpreting the Margin Statement

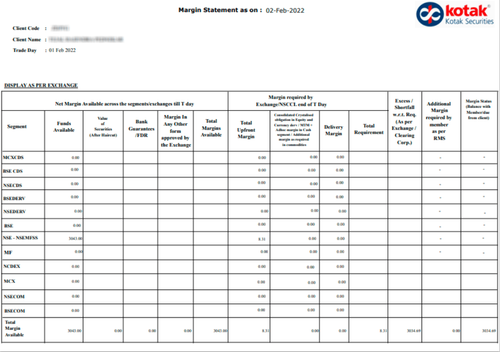

All brokers are obligated to disclose the details given below in the daily margin statement. The following is an example of a daily margin statement:

Funds – This column shows the closing balance of every segment’s ledger after reversing the T-day credit in the CDS and derivatives segment. Likewise, closing balance in BSE EQ and NSE EQ segments is reflected after reversing the effect of T-day and T-1 day credit.

Value of Securities (After Haircut) – This column includes any margins from pledging investments if any, i.e., collateral margins.

Total Upfront Margins – In this column, you will see the total margins needed by the exchange for the positions you have taken. The following are margin values taken into account for each segment.

- Equity – VaR + ELM + Minimum Margin + Additional Margin

- Derivatives – SPAN Margin + Exposure Margin + Physical Delivery Margin + Additional Margin

- CDS – SPAN Margin + Extreme Loss Margin + Additional Margin

Consolidated Crystallized Obligation – This includes the sum of any MTM losses in the respective segments.

Total Requirement – Here you can see the total amount blocked by the exchange for your position based on the segments. The Total Requirement is calculated using the sum of Total Upfront Margin + Consolidated Crystallized Obligation.

Excess/Shortfall w.r.t Req (As Per Exchange/Clearing Corps.) – In this section, you can check the value of Total Margin Available minus the value of Total Requirement.

Additional Margin required by the member as per RMS – This section reflects any additional margins that are blocked by the broker.

Margin Status (balance with member/due from the client) – Here you can see the totally free/unencumbered balance that is accessible for taking new trade positions on the next trading day.