How do I short sell shares in F&O segments?

Choose a platform

- Search for the underlying you want to short sell.

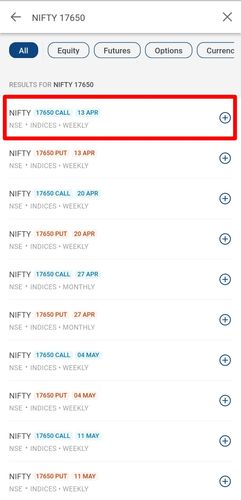

- Once you click on search you have to type the name of the scrip and the strike you want to trade in.e.g. “NIFTY 18000”. You will see the call and put option contracts of different expiries with the most recent expiry contract at the top and so on and so forth.

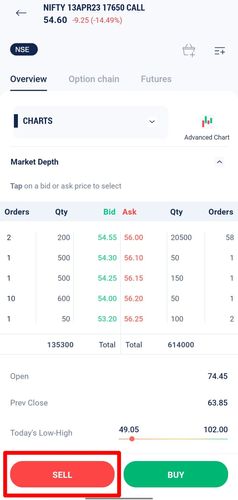

- You have to tap on the contract that you want to trade (NIFTY 18000 CALL 17 NOV) and then you will see an option to sell the contract.

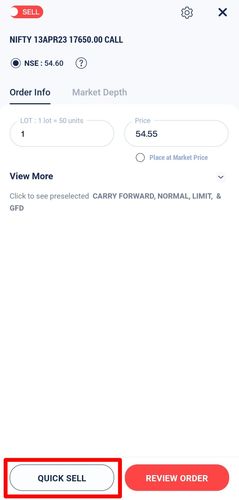

- Once you click on sell you have to enter the no. of quantity you want to trade and select the option between market or limit. You can also choose to add a stop loss by enabling the “Add stop-loss trigger” toggle. You also have an option to switch to MIS order (intraday) by enabling the “Auto square off” toggle.

- Once you enter all the fields you have to swipe on “Swipe to sell” button on the bottom of the screen and your short sell order will be sent to the exchange.

If you want to short sell any F&O contract you can follow the below steps.

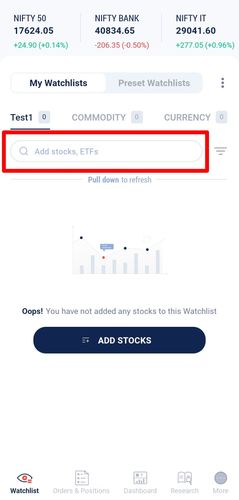

- Click on search bar of the watchlist.

- Type in the trading symbol [Nifty] followed by the strike price. You'll see a drop-down of the existing contracts for that strike price and click on any of the contracts that you want to sell. The top most contracts visible will be of the nearest expiry.

- After clicking on the contract you can see the option to sell.

- Once you click on the sell option, fill in the rest of the details i.e. the number of lots and the rate at which you want to sell the contract. Once you fill In all the required details you can click on quick sell and execute the order.

This feature is not allowed for this platform.

Still have questions?

Why is there a mismatch of profit and loss and the quantity of my open positions on InstaTrade and the Neo App/Web?

When I have squared off my positions, why are they still reflecting as an open positions on InstaTrade?

Why was the InstaTrade square-off order rejected?

If I modify or cancel my InstaTrade orders from the Neo App/Web, will it update on InstaTrade as well?