How can I place a Bracket order on Neo platforms?

Choose a platform

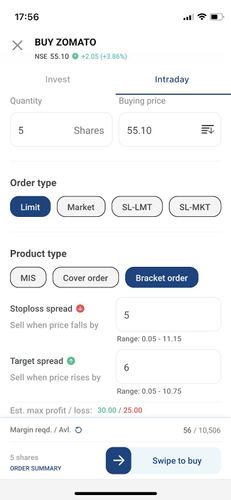

On the Order form - switch to the Intraday section and select the Bracket order product type.

- Enter the Quantity and Buying Limit Price. (In this example, Let's take 5 shares of Zomato as quantities and a Buying limit price of Rs. 55.10)

- Under the Bracket order section, Define the Stoploss spread (difference from your buying limit price) and the Target spread (difference from your buying limit price).

- The spread range will be displayed for your reference, calculated based on the minimum tick size and the difference between your buying limit price and upper or lower daily price range.

- In this example, let’s have the Stolposs Spread as Rs. 5 and Target Spread as Rs. 6.

- Accordingly, you can also see the estimated max profit or loss value Loss: Rs. 5 x 5 shares = Rs. 25 & Profit Rs. 6 x 5 shares = Rs. 30

- Swipe to Buy to proceed further with the order placement.

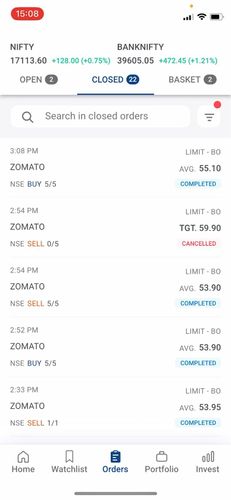

- The Leg-1 Buy-order once completed (traded) gets displayed under “Closed section” (Order completed with Buying price at Rs. 55.10)

- And the Stoploss (Leg-2) and Target (Leg-3) gets displayed under “Open section”

- Stoploss Trigger Order at Rs. 50.10 (55.10 minus spread of 5)

- Target Order at Rs. 61.10 (55.10 add spread of 6)

Further, Either the Stoploss or Target order will get executed based on the price movement, and the other order will get auto-canceled, resulting in a square-off of your bracket order position.

This feature is not allowed for this platform.