Indian Banking Sector on a Growth Trajectory

Positives for the Indian Banking Industry

The Indian banking sector has witnessed several changes over the years, and the adoption of digital technologies has been significant among them. Banks have also undergone a significant change in the form of privatization. Although the government still owns most public sector banks, the entire sector is gradually becoming privatized.

In March 2010, public sector banks held 75.1% of outstanding bank loans and 74.2% of deposits. Private banks now hold a larger portion of loans, increasing from 17.5% to 37.3%. Their share of deposits has also grown, rising from 17.7% in March 2010 to 31.4% in September 2022.

Over the last ten years, Indian banks have shown strong credit growth, advancing at a healthy rate of about 10%. These banks have steadily provided loans and credit to individuals and businesses, helping them meet their financial needs and aspirations.

Bad loans have been the bane of the banking industry for long. However, banks have reduced their bad loans from ₹10.4 trillion in March 2018 to ₹7.4 trillion in March 2022. With fewer bad loans, banks can potentially lower interest rates for all customers. This is because the overall risk associated with lending decreases, leading to more favourable terms for borrowers.

Top Banking Stocks to Invest In

Some of the top banking stocks that you invest in are:

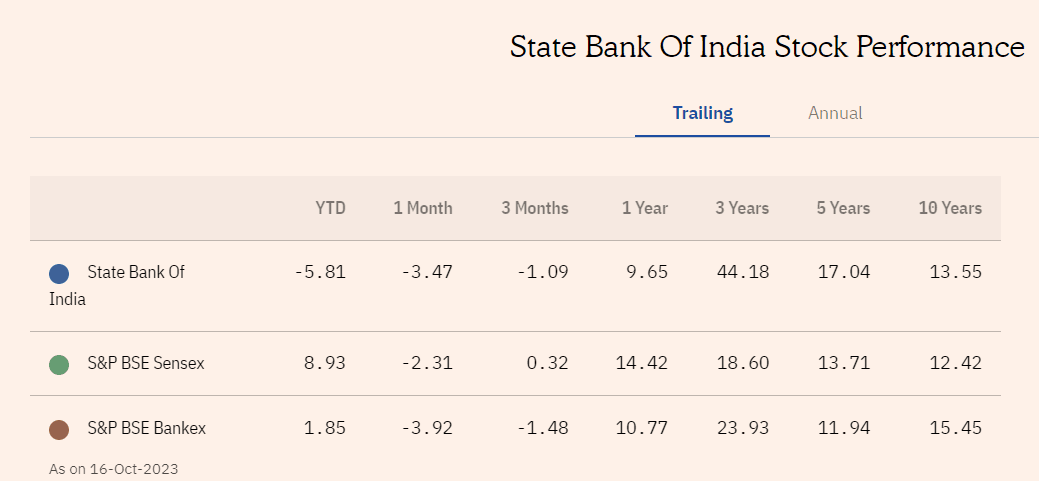

1. State Bank of India

With its extensive reach, robust financial performance, and government backing, SBI remains a favourite among investors seeking stability and growth in the banking sector. As a key player in India's economic growth story, SBI's strategic positioning and resilience make it a go-to stock for those looking for long-term investment prospects.

- As of 16th October 2023, 3-year trailing returns of SBI stocks stood at 44.18%

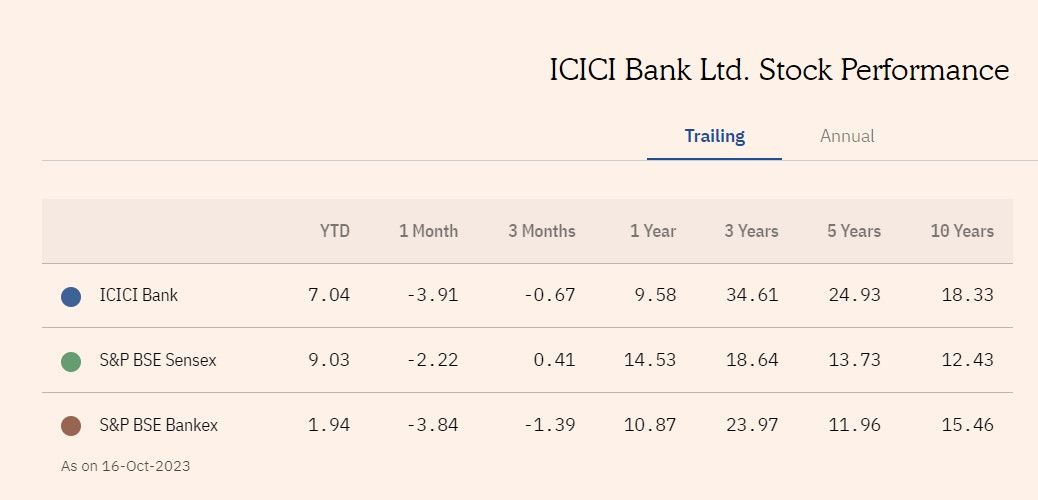

2. ICICI Bank

With a strong track record of stability, innovative services, and consistent growth, ICICI Bank is a preferred choice for investors seeking reliability and potential returns in the dynamic banking sector. Its prudent management, technological advancements, and wide range of financial products make it a cornerstone investment in the Indian banking landscape.

- As of 16th October 2023, the 3-year trailing returns of ICICI Bank’s stock stood at 33.61%.

Bank on StockCase from Kotak Securities to Invest in Banking Stocks

The First Time Favourites Basket, one of the StockCase baskets, allows you to invest in the stocks of these two significant players in the banking sector, SBI and ICICI Bank, hassle-free and build a diversified, long-term, and low-cost portfolio.

With our experts keeping a close watch on the market trends, all you need to do is invest, and we will take care of the rest. So, what are you waiting for? Join the community of happy investors benefiting from the First Time Favourites Basket via StockCase investment. Begin your StockCase journey today.