FMCG Industry in India Soaring to New Heights

Driving Force Behind India’s FMCG Sector

The Indian FMCG industry is expected to grow at a CAGR (compound annual growth rate) of 14.9%, from USD 110 billion in 2020 to a staggering USD 220 billion in 2025. One big reason for this growth is the rise of larger-sized product packages. People are showing a clear trend of switching to medium and high-value packages for various FMCG products.

Also, with consumers getting better deals on larger packs, this is creating a win-win situation for both parties. At the same time, government initiatives such as 51% foreign direct investment (FDI) in multi-brand retail and 100% FDI in food processing have further propelled the growth of the sector.

This has made it easier for players in the sector to make and sell products, create jobs, and make people notice their brands. In 2020, the government’s plan to uplift the sector even more through the production-linked incentive scheme (PLI) has worked really well. This has boosted exports and manufacturing capacity.

Promising FMCG Stocks

Some of the stocks you can contemplate investing are:

ITC Limited

Headquartered in Kolkata, ITC has established itself as a leading player in various sectors, including FMCG, agribusiness, hotels, information technology, and paperboards and packaging. With a commitment to creating enduring value for all its stakeholders, ITC is renowned for its sustainability initiatives and innovative products that cater to the evolving needs of consumers.

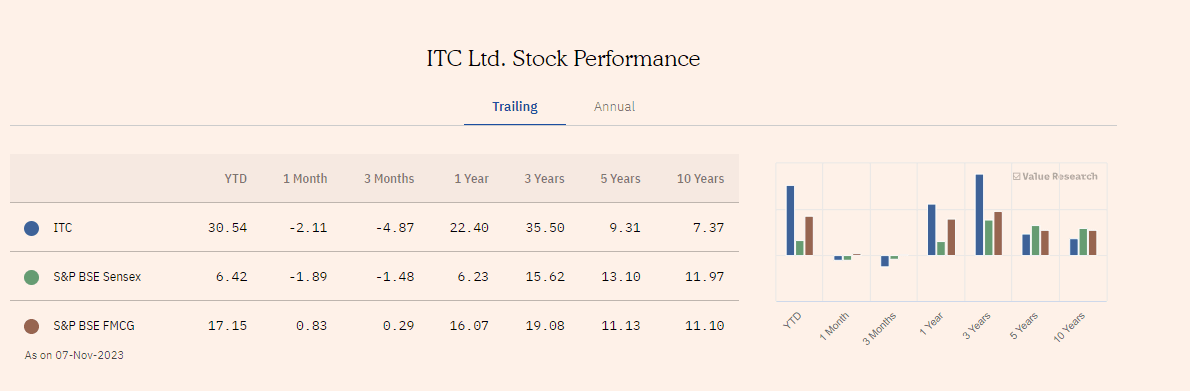

As of 7th November 2023, the 3-year-trailing return from ITC Ltd’s stock stood at 35.50%.

Source: Value Research

Tata Consumer Products Ltd

Tata Consumer Products Ltd is a prominent and diversified consumer goods company that forms an integral part of the Tata Group, one of India’s largest and most respected conglomerates. With a rich history dating back to 1962, the company has consistently striven to enhance the quality of life for consumers through a wide range of products, spanning categories such as tea, coffee, water, and ready-to-eat foods.

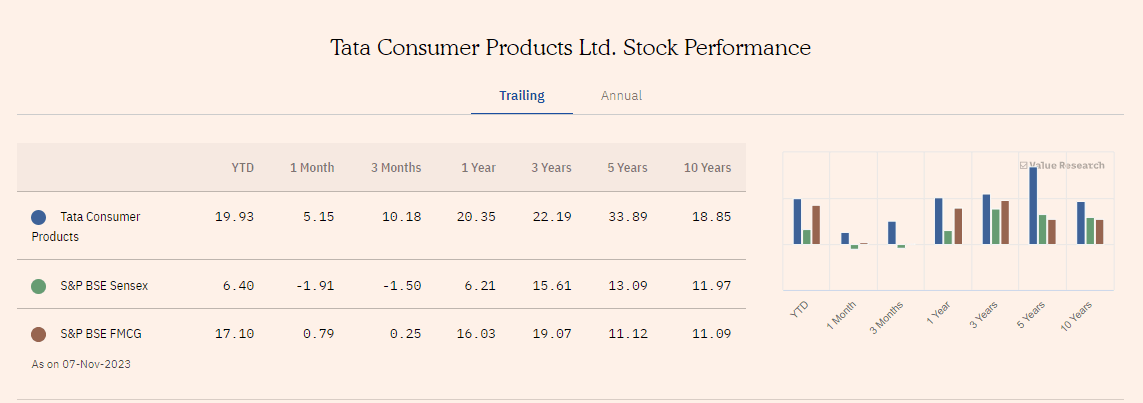

As of 7th November 2023, the 3-year-trailing returns from Tata Consumer Products Ltd’s stock stood at 22.19%.

Source: Value Research

Jubilant FoodWorks Limited

Jubilant FoodWorks Limited is a renowned Indian food service company that operates as the master franchisee for Domino’s Pizza in India and several other countries. With a strong presence in the Indian quick-service restaurant industry, the company has consistently demonstrated impressive growth and innovation.

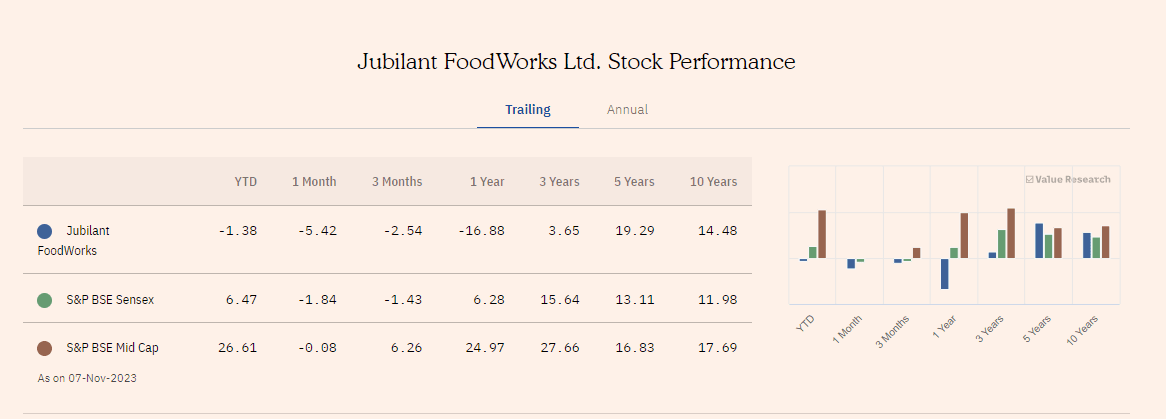

As of 7th November 2023, the 3-year-trailing returns from Jubilant FoodWorks Limited’s stock stood at 3.65%.

Source: Value Research

Invest Seamlessly in FMCG Stocks With Daily Essentials Basket

The Daily Essentials Basket from Kotak Securities’ StockCase allows you to invest in these promising FMCG stocks on the go and boost your wealth. Many investors are already investing through StockCase. It’s your turn now. To know more, click here.