Banking Stocks That Deserve Your Attention

Banking Stocks to Buy

1. State Bank of India - Banker to Every Indian

Imagine wandering into the tiniest village or bustling city, and there is an SBI branch – a familiar face in every nook and corner. SBI isn’t just a bank but a companion in the financial journey of individuals and businesses nationwide. Its branches aren’t just buildings; they are gateways to financial inclusion, making banking services reach even the country's remotest corners.

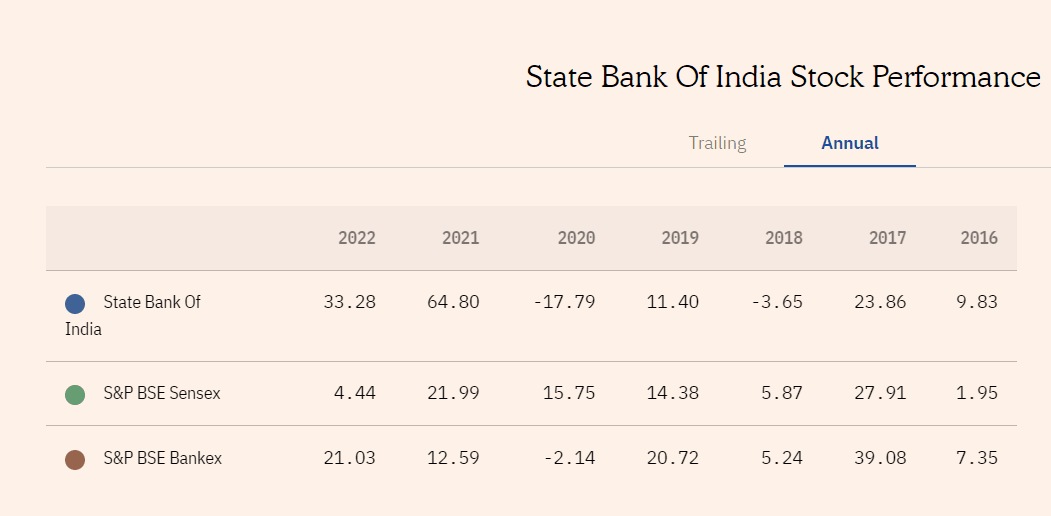

SBI is the banker to every Indian, a title earned through years of dedicated service and vast presence. As per its annual report 2022-23, the bank had 22,405 branches with a 22.99% market share of deposits. It has something for everyone. Whether you are a saver starting small or an investor diving into the complexities of finance, SBI has your back. Annual returns of SBI stocks stood at 33.28% in 2022, much higher than the S&P BSE Bankex at 21.03% (image below).

Source: Value Research

2. ICICI Bank - Synonymous With Private Sector Banking Growth

1991 was a landmark year for India. The country had started economic reforms and was taking its first steps towards liberalization. This was when things were about to shift, and the winds of change were blowing strong. Amid this transformation, a financial trailblazer emerged that would become synonymous with the changing face of India's banking sector – ICICI Bank.

Incorporated in 1994 as a part of the ICICI Group, ICICI Bank came to the forefront as the face of dynamism and innovation in private banking. It was a pioneer in retail banking. Back then, they thought serving individual customers could be a game-changer. And they were right! This foresight didn't just change how Indians handled their money; it also contributed a big part to the growth of retail banking in the country.

ICICI Bank didn't just stop at banking. It went on to become the cool kid in town with its bag full of innovative financial products. Whether it was introducing Internet banking when the Internet was still finding its feet or launching digital wallets that made transactions a breeze, ICICI was the trendsetter, always one step ahead.

While SBI represents the public sector's stalwart presence, ICICI Bank epitomizes the dynamism and innovation of the private banking sector in India. Annual returns from ICICI Bank's stocks stood at 20.36% in 2022, slightly less than S&P BSE Bankex at 21.03%, but much higher than S&P BSE Sensex at 4.44% (see image below).

Source: Value Research

Investing in Banking Stocks Through First Time Favourites Basket

The First Time Favourites Basket, one of the prominent baskets of StockCase, allows you to get the best of both worlds in the banking sector - public and private. It enables you to invest in SBI and ICICI Bank stocks seamlessly and participate in the growth story of these two stalwarts in the Indian banking sector. So, what are you waiting for? Join the long list of investors who have benefitted through StockCase investment. To know more, click here.